Buying a home in the UAE just got easier. REEF Developments has announced a groundbreaking initiative to eliminate down payments for salaried UAE residents, removing one of the biggest barriers to property ownership and investment in the Emirates.

Breaking Down the Announcement

Traditionally, property buyers in the UAE face a significant upfront cost—a down payment of at least 20% of the property value. For many salaried professionals, this lump-sum requirement has been a major obstacle, even when they have stable income and strong repayment ability.

REEF Developments’ new model eliminates this hurdle, enabling salaried residents to enter the property market without the usual financial strain.

Why This Move Matters

1. Expanding Access to Property Ownership

This initiative opens the door for thousands of mid-income earners who have been priced out of the market despite having steady jobs. It aligns with the UAE’s push toward greater housing accessibility and long-term residency incentives.

2. Boosting Investor Confidence

For investors, this move signals innovative financing structures that can expand buyer pools and support sustained demand in the residential sector. More demand translates into stronger price stability and potential appreciation.

3. Supporting UAE’s Real Estate Growth

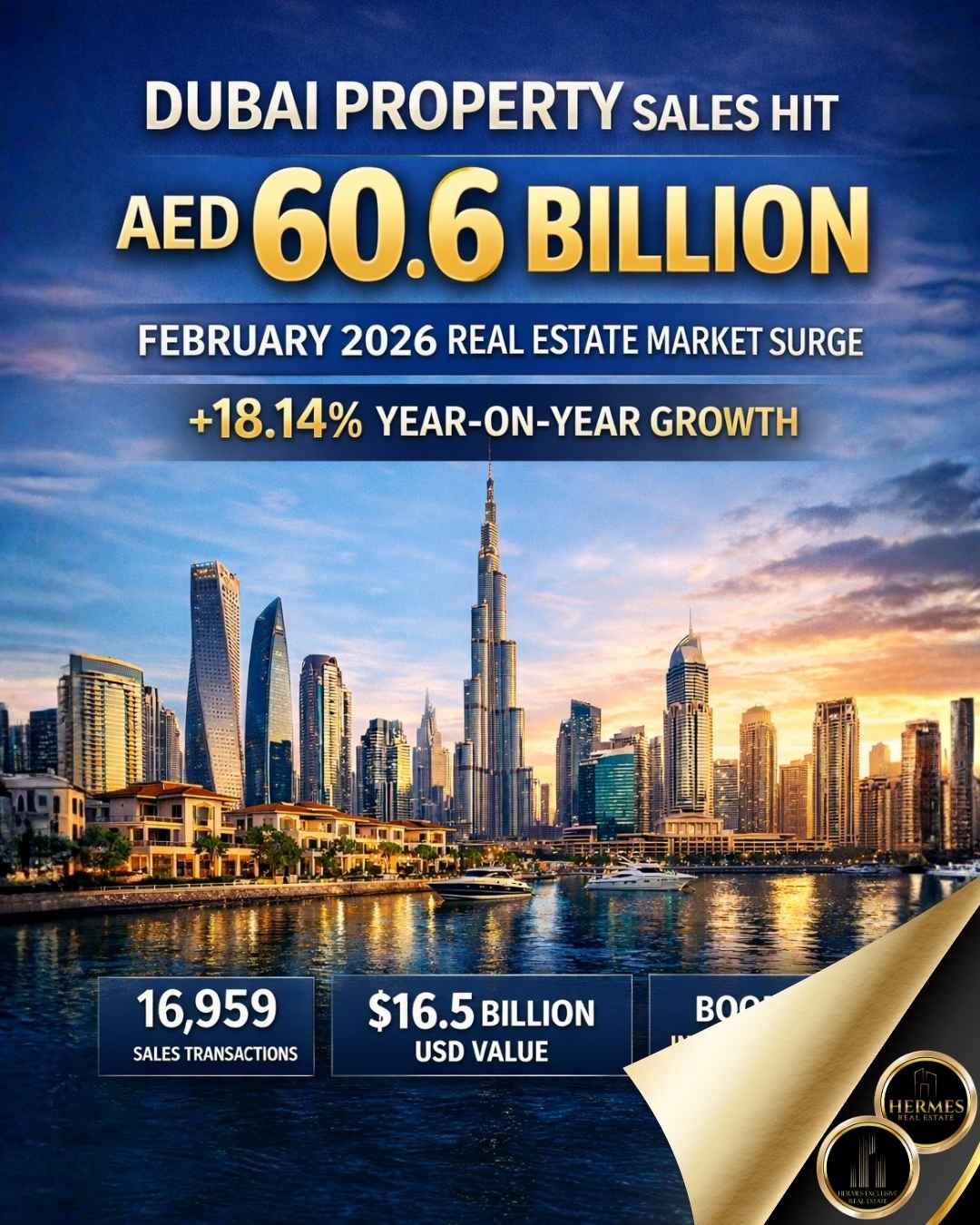

With Dubai recording AED 50.7 billion in deals in August 2025 and Abu Dhabi hitting $16.65 billion year-to-date, policies like this amplify market activity by bringing more first-time buyers and end-users into play.

Opportunities & Risks for Buyers

Opportunities

- No upfront cost: Easier market entry for salaried professionals.

- Wealth building: Allows residents to shift from renting to ownership, building equity over time.

- Market timing: Buyers can capitalize on Dubai’s ongoing growth phase without waiting years to save a down payment.

Risks

- Higher long-term commitments: While upfront payments are waived, buyers must carefully evaluate monthly commitments.

- Market volatility: Investors should assess resale and rental potential, especially in emerging communities.

A Mini Case Study

Consider a mid-level professional earning AED 20,000 per month. Under traditional rules, buying a property worth AED 1 million would require a AED 200,000 down payment, a figure that could take years to save.

Under REEF Developments’ scheme, this buyer could enter the market immediately, using their monthly income to service payments. This accelerates ownership and redirects funds from rent into equity.

Looking Ahead

By removing the down payment barrier, REEF Developments is reshaping the real estate landscape turning long-term renters into homeowners and expanding the buyer base in one of the world’s most dynamic property markets.

For investors, this means higher liquidity, stronger absorption rates, and new opportunities in communities where REEF operates. For salaried residents, it’s a once-in-a-generation chance to own a piece of the UAE without the weight of upfront costs.